THE ASCENT FUND

Invest in a dynamically managed portfolio with an emphasis in the Innovation Economy

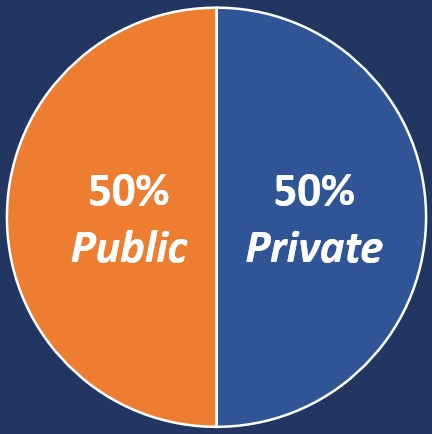

The Avitas Capital Ascent Fund seeks to generate superior returns applying a multi-asset investment strategy that dynamically allocates capital among private, late-stage companies and public assets. The fund focuses on leading innovation economy companies.

How does it work?

The Ascent Fund is designed to diversify your investment portfolio by allocating to both public & private markets.

Series B closed

The Legacy Fund

Private companies expected to realize a liquidity event within one-to-three years

Emphasis on companies in the Innovation Economy such as technology, healthcare and digital media

Complimented by an active long/short trading strategy utilizing publicly-traded securities and listed options

Select Current Holdings. View full portfolio

Series C closed

The Follow Up

Private companies expected to realize a liquidity event within one-to-three years

Emphasis on companies in the Innovation Economy such as technology, healthcare and digital media

Complimented by an active long/short trading strategy utilizing publicly-traded securities and listed options

Select Current Holdings. View full portfolio

Series D OPEN

The Follow Up

Private companies expected to realize a liquidity event within one-to-three years

Emphasis on companies in the Innovation Economy such as technology, healthcare and digital media

Complimented by an active long/short trading strategy utilizing publicly-traded securities and listed options

Series D is now open and in the initial, active discovery phase of portfolio selection.